Unlock State-by-State E-Bike Rebates & Tax Credits in 2025-2026: Save Big on Eco-Friendly Transportation!

- By imdad

- 0 Comments

- Posted on

E-bikes are becoming a popular alternative to traditional transportation, offering a fun, green, and cost-effective way to get around. The best part? You can save money while contributing to a greener future through state-level rebates, federal tax credits, and local incentives. In 2025-2026, there are more ways than ever to reduce the upfront cost of your ebike. Our comprehensive guide breaks down how you can maximize your savings based on where you live.

Why E-Bikes?

E-bikes offer a range of benefits:

- Cost Savings: They’re much cheaper to operate and maintain than traditional cars.

- Eco-Friendly: E-bikes help reduce traffic congestion and lower carbon emissions, making cities greener.

- Health Benefits: E-bikes are a great way to stay active while commuting or running errands.

If you’re thinking about purchasing an e-bike, now is the perfect time to take advantage of various e-bike rebates and tax credits available across the United States.

Key Takeaways:

- E-bike rebates and tax credits can significantly reduce the cost of your e-bike.

- State incentives make eco-friendly transportation more affordable and accessible to everyone.

- The federal government offers up to $1,500 in tax credits for eligible e-bikes.

- Local governments and utility companies often provide additional rebates and discounts.

Federal E-Bike Programs & the E-BIKE Act

The federal government is committed to supporting sustainable transportation, and the E-BIKE Act is one of the major initiatives driving this change. This program offers tax credits for purchasing ebikes and also funds ebike-friendly infrastructure like bike lanes and charging stations.

Federal Tax Credit

Since 2020, U.S. citizens can receive up to $1,500 in tax credits for purchasing an e-bike. To qualify:

- The e-bike must have a top speed of 28 mph.

- It should feature a motor of at least 750 watts.

In addition to tax credits, the E-BIKE Act includes grants for creating better e-bike infrastructure, which makes biking in cities easier and more efficient.

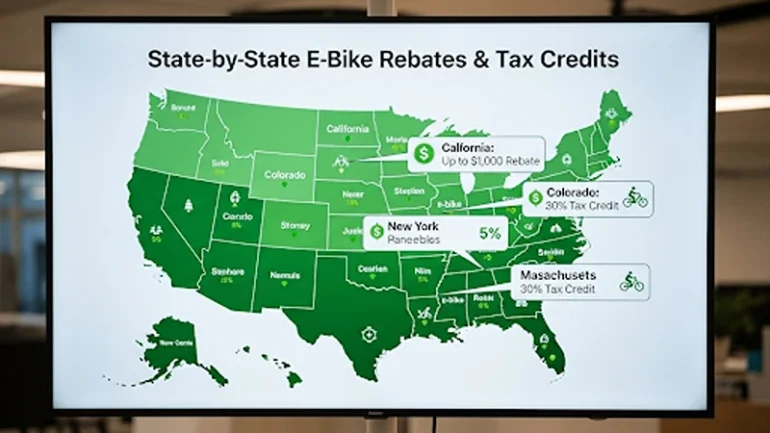

Maximize Your Savings: State-Level E-Bike Incentives

Many states offer their own rebates and tax credits to further reduce the cost of e-bikes. Combining state, federal, and local incentives can provide you with substantial savings.

Here’s a breakdown of the top state programs for 2025-2026:

California: Enhanced Rebate Program

- Rebate Amount: Up to $1,500

- Eligibility: Available to California residents purchasing Best ebikes.

- Details: California offers one of the most generous e-bike rebate programs in the nation. You can qualify for up to $1,500 to cover your e-bike purchase, helping make this green transport more affordable.

Colorado: Climate-Action Incentives

- Rebate Amount: Varies

- Eligibility: Residents of Colorado.

- Details: As part of its climate action initiatives, Colorado provides rebates for electric bikes and other clean transport options. This program helps lower the cost of e-bike adoption and encourages sustainable commuting.

New York: Green Transportation Initiative

- Rebate Amount: Varies

- Eligibility: Available to New York residents.

- Details: New York’s Green Transportation Initiative offers rebates to encourage the use of eco-friendly transport, including e-bikes. Check the specific requirements to see if you qualify for savings.

Washington: Clean Mobility Programs

- Rebate Amount: Varies

- Eligibility: Washington residents.

- Details: Washington provides a range of incentives to support clean mobility, including rebates for e-bike purchases and other electric transportation options.

Local Government & Utility Company Incentives

In addition to state and federal rebates, local governments and utility companies offer additional discounts to encourage eco-friendly transportation.

Examples of Local Programs:

- City E-Bike Rebates: Many cities offer rebates or tax credits for e-bike purchases. Cities like San Francisco and New York have implemented e-bike-sharing programs, reducing the need for individual ownership.

- Utility Company Discounts: Some utility companies partner with local shops to offer special deals on ebikes. These offers help make e-bikes more affordable and accessible to a broader audience.

Make sure to check with your city’s website or local bike shops to see if any additional programs are available in your area.

Special E-Bike Programs & Eligibility Requirements

Some states and cities offer special programs for businesses, low-income families, and specific groups that need transportation solutions. Here are some programs to look out for:

Income-Based E-Bike Incentives

- Who Can Apply: Low-income individuals or families.

- Benefits: These programs provide financial assistance to help those with limited resources purchase e-bikes.

Cargo E-Bike Rebates

- Who Can Apply: Businesses and commercial users.

- Benefits: Companies that plan to use ebikes for delivery or business purposes can qualify for rebates. These programs encourage businesses to switch from gas-powered vehicles to electric options, saving money and reducing emissions.

Commercial E-Bike Programs

- Who Can Apply: Businesses with specific requirements.

- Benefits: Companies that meet certain criteria (such as employee count or industry) may be eligible for discounts or rebates on e-bikes used for commercial purposes.

How E-Bikes Help You Save Money in the Long Run

While the initial cost of an ebike may seem like a significant investment, Best electric bikes offer long-term savings that make them a smart choice. Here’s how:

1. Reduced Transportation Costs

E-bikes are much cheaper to maintain than cars. The cost of charging an e-bike is a fraction of the cost of fueling a car. You can also avoid expensive car insurance, gas prices, and parking fees.

2. Employer and Government Incentives

In addition to rebates, some employers offer subsidies or bike parking stations with charging points for employees who commute via e-bike. This can further reduce your commuting costs.

3. Increased Productivity

For businesses, e-bikes reduce commuting time and help employees arrive at work more energized. They’re also a great option for local deliveries, saving money on fuel and vehicle maintenance.

Maximizing Your E-Bike Savings

To get the most out of your ebike purchase, follow these tips:

- Combine federal, state, and local rebates to maximize your savings.

- Look for discounts during seasonal sales or special events like “E-Bike Bonus Days.”

- Make sure you have all required documentation for a smooth application process.

Pro Tip: Save even more by purchasing your e-bike at the start of the year, when many new incentives are available.

The Future of E-Bikes: What’s Next for 2025-2026 and Beyond?

As electric bike technology evolves, expect improvements in battery life, motor systems, and smart features. The integration of features like GPS tracking, real-time health monitoring, and automatic speed adjustments will make e-bikes even more practical for daily use.

Key Innovations:

- Longer Battery Life: Ebikes will feature batteries that last longer and charge faster.

- Eco-Friendly Materials: Look for future e-bikes made from recyclable materials, further reducing their environmental impact.

- Smart Technology: Expect more e-bikes to come with features like app connectivity and autonomous ride modes.

By 2025-2026, ebikes will not only be more accessible but also smarter and more efficient, making them an even better choice for both short commutes and long rides.

Conclusion: A Greener, More Affordable Future with E-Bikes

The future of transportation is eco-friendly, and e-bikes are leading the way. With numerous incentives and rebates available, there has never been a better time to switch to e-bikes. Whether you’re an individual, a business owner, or someone in a rural area, there are programs that can make e-bikes more affordable.

Don’t miss out on the incredible savings! Check out the state-specific rebate programs in your area and see how you can make the switch to greener transportation today.

Related Blogs

- The Ultimate Guide to Understanding Electric Bikes

- The Top Fastest Electric Bikes of 2025

- Best EBikes for Seniors in 2025: Top E-Bikes for Sale

- The Best E-Bikes of 2025: Top Picks for Every Rider

- State-by-State Guide to E-Bike Rebates and Tax Credits (2025)

- Top 5 E-Bikes (2025)

- FutureEV Bike: Conquer Michigan’s Trails & Cities with the Ultimate Premium E-Bike Experience (2025 Guide)

- Electric Bikes for Seniors in Utah: Rediscover Freedom

- Which is the Best Electric Bike? Your Ultimate Guide to Choosing the Perfect Ride

- Michigan E-Bike Commuting: Navigate Laws & City Streets with FutureEV Bike

FAQs

1. What are the current federal e-bike tax credits and grants available?

The E-BIKE Act offers up to $1,500 in tax credits for new e-bike purchases. New grants will support infrastructure and help expand e-bike use across the country.

2. What state-level e-bike rebates and tax credits are available in 2025-2026?

Many states, including California, Colorado, New York, and Washington, offer rebates ranging from $500 to $1,500 to encourage e-bike adoption.

3. How can I maximize my e-bike savings?

Combine state, federal, and local rebates, purchase during E-Bike Bonus Days, and ensure all your documentation is ready to qualify for the maximum discount.